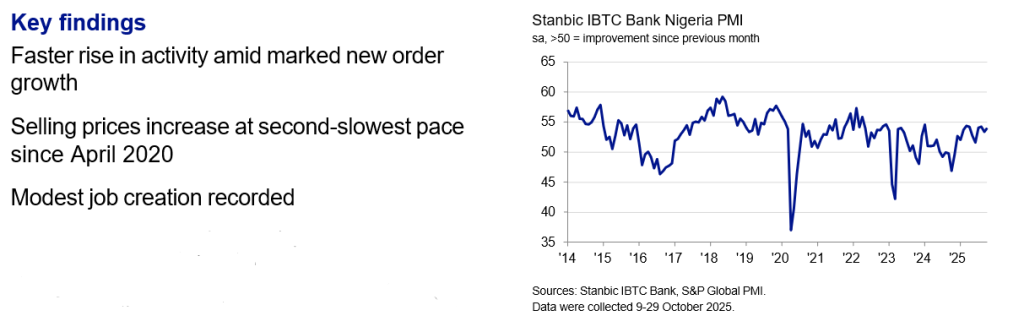

October data pointed to improved growth momentum in the Nigerian private sector, with both output and new orders increasing at sharper rates than in September. In turn, companies took on extra staff and expanded their purchasing activity. The pace of input cost inflation remained subdued relative to the picture over recent years, while output prices increased at the second-slowest pace for five-and-a-half years.

The headline figure derived from the survey is the Purchasing Managers’ Index™ (PMI®). Readings above 50.0 signal an improvement in business conditions on the previous month, while readings below 50.0 show a deterioration.

The headline PMI rose to 54.0 in October from 53.4 in September, signalling a solid monthly improvement in the health of the private sector and one that was more pronounced than in the previous survey period. Business conditions have now strengthened in 11 consecutive months.

Output growth hit a six-month high in October, with panellists highlighting the positive impact of rising new orders and the introduction of new products. Business activity increased across all four broad sectors, with growth fastest in manufacturing.

The launch of new products also helped to drive up customer numbers in October, thereby feeding through to rising new orders. A recent softening of inflationary pressures also reportedly helped to boost demand.

Although companies continued to increase their selling prices at a marked pace in response to higher input costs, the latest rise in charges was the second-slowest for five-and-a-half years, quicker only than that seen in August.

The rate of input cost inflation ticked higher, however, amid faster increases in both purchase prices and staff costs. That said, the increase in input prices was still muted compared to those seen in 2023 and 2024.

Rising new orders encouraged firms to take on extra staff in October, the fifth month running in which this has been the case. The rate of job creation was only modest, however, and softer than seen in September.

Higher employment helped firms to keep on top of workloads, but power outages and payment delays from clients led to build-ups in backlogs elsewhere. On balance, outstanding business was broadly unchanged in October.

Both purchasing activity and stocks of inputs increased as companies responded to higher new orders and the prospect of further expansions in the months ahead. Meanwhile, suppliers’ delivery times continued to shorten.

Although strategies around marketing and exporting supported confidence in the year-ahead outlook for business activity, sentiment dropped for the fourth month running in October and was the lowest since May. Around 46% of respondents predicted a rise in output over the next 12 months.