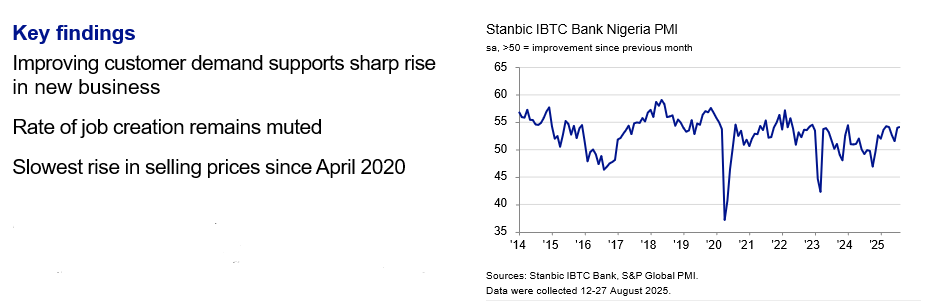

Growth in the Nigerian private sector continued to gain momentum during August as customer demand improved and inflationary pressures softened. Sharper increases in output and new orders were recorded, although rates of expansion in purchasing activity and employment eased. Meanwhile, business confidence softened but firms remained optimistic that output will increase over the coming year.

The headline figure derived from the survey is the Purchasing Managers’ Index™ (PMI®). Readings above 50.0 signal an improvement in business conditions on the previous month, while readings below 50.0 show a deterioration.

At 54.2 in August, the headline PMI was above the 50.0 no-change mark for the ninth month running, signalling a sustained improvement in the health of the Nigerian private sector. Moreover, the latest reading was up from 54.0 in July, pointing to a solid strengthening of business conditions and one that was the most pronounced since April.

The rise in the headline index primarily reflected sharper expansions in output and new orders, with rates of growth hitting four- and 19-month highs respectively. Panellists reported stronger customer demand and a greater willingness among clients to commit to new projects.

Output increased across three of the four broad sectors covered by the survey, the exception being manufacturing.

While firms continued to expand staffing levels in response to higher new orders, the rate of job creation was only slight and softer than that seen in July. Companies were nonetheless able to deplete outstanding business for the first time in five months.

A slower increase in purchasing activity was also registered in August. Nonetheless, input buying rose markedly in response to improving customer demand, with positive expectations for the future also encouraging firms to accumulate inventories.

Expectations for output growth over the coming year reflected predictions of higher new orders, the opening of new branches and advertising activity. Sentiment eased for the second month running, however, and was relatively muted.

Inflationary pressures waned midway through the third quarter. The pace of increase in purchase prices slowed for the fourth consecutive month and was the weakest since March 2020.

Meanwhile, the pace of staff cost inflation eased to a three-month low. Where wages increased, panellists linked this to incentives for faster project delivery and cost-of-living payments.

In line with the picture for input costs, the pace of output price inflation also eased in August, slowing for the fourth month running to the weakest in almost five-and-a-half years. The latest rise was also softer than the series average, despite remaining marked as companies passed higher costs through to their customers.