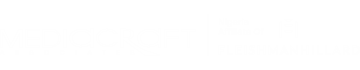

The Nigerian private sector remained in growth territory as the first half of 2025 drew to a close, and business confidence improved markedly in June. That said, rates of expansion in output, new orders and purchasing eased from May. Although rates of inflation remained relatively sharp, there were further signs of cost pressures softening and companies raised their output prices at the slowest pace in just over two years.

The headline figure derived from the survey is the Purchasing Managers’ Index™ (PMI®). Readings above 50.0 signal an improvement in business conditions on the previous month, while readings below 50.0 show a deterioration.

The headline PMI remained above the 50.0 no-change mark for the seventh consecutive month in June. That said, at 51.6, the reading was down from 52.7 in May and the lowest in the current growth sequence. The PMI signalled a modest improvement in business conditions in the private sector.

The rate of output growth eased particularly sharply, slowing for the second month running to a seven-month low. Sector data indicated that the slowdown in the pace of expansion reflected a fall in manufacturing production as activity continued to rise elsewhere.

Where output rose, respondents linked this to higher new orders and the securing of new customers. Indeed, new business increased solidly in June, albeit here too the pace of expansion slowed and was at a five-month low.

While the pace of output growth eased in June, companies were much more optimistic about the outlook for the coming year. Sentiment improved to the highest since August 2022 and moved closer to the series average after a period of relatively weak optimism. Those respondents that predicted a rise in activity over the next 12 months linked this to planned investment in improving and expanding operations.

Staffing levels were kept broadly stable in June following a marginal reduction in May. Meanwhile, purchasing activity continued to rise, but as was the case with output the pace of expansion slowed. This fed through to a weaker rise in inventories, which increased at the slowest pace in the current seven-month sequence of accumulation.

Backlogs of work increased for the third consecutive month, and at a modest pace that was broadly in line with that seen in May. Panellists linked higher outstanding business to shortages of materials, delayed payments from customers and power supply issues.

Suppliers’ delivery times were broadly unchanged in June, ending a period of shorter lead times stretching back to March 2023. Some firms noted that poor road conditions had caused delays.

Purchase costs increased sharply in June, but the pace of inflation eased to a 25-month low. On the other hand, staff costs increased at a faster pace. With overall input price inflation slowing, companies also raised their output charges at a weaker rate, the softest since May 2023.